tax incentives for electric cars uk

There are many incentives for buying an electric car in the UK including plug-in car grants zero or reduced road tax bills and accessible on-the-go electric charge points across UK road. Aside from the electric car tax benefits outlined above.

A Complete Guide To Ev Ev Charging Incentives In The Uk

You can receive up to a maximum of 5000 towards the purchase of a new battery electric vehicle BEV with the amount dependent on the list price of the vehicle capped at a.

. Company car tax rates start from around nine per cent. For a plug-in hybrid electric vehicle. 20 of the cost of a large electric van or truck up to a max.

Fully electric vehicles are exempt from road tax in subsequent years too including new EVs valued at over 40000 which get an exemption from the 355 of extra vehicle tax normally. Plug-in Car Grant levels provide up to 1500. This tax credit is available for both new and used.

The UK Government has been urged to adapt the successful incentives for zero emission company cars so that more private buyers can be encouraged into EVs too. An additional incentive scheme allocates 4000 for switching a diesel vehicle of 11 years or more for a new battery electric vehicle BEV. So if youre a 20-rate.

The BiK rate will rise to 2 percent in. Road Tax is reduced on hybrid vehicles as there are not many. 20 of the cost of an electric taxi up to a max.

With 2 of 27280 being 54560 thats the amount of taxable benefit you receive but you dont pay all that only a percentage based on your tax bracket. Putting it into context a 20 standard rate tax payer will save 20 in tax for every 100 of monthly lease with 40 tax payers saving 40. On an electric car it would be 0 and next year it would rise to 1 of the sale price.

Of 20000 for first 200 orders after that up to a max. Drivers who find themselves. That represents a very large personal tax saving.

Company Car Tax Benefit in Kind From 6th April 2021 both new and existing Tesla cars are eligible for a 1 percent BiK rate for the 202122 tax year. Significant savings in running costs for electric cars compared to petrol or diesel equivalents can often exceed the current 1500 value of the grant and electric car drivers will. At present there are only 50 electric vehicles registered as company cars out of 11 million company cars on the road.

There are further financial incentives associated with driving an electric vehicle. The Electric Vehicle Homecharge Scheme EVHS provides a grant of up to 75 percent or up to 350 including VAT towards the cost of installing an EV charge point at. Are There Tax Incentives For Electric Cars In The United Kingdom.

This means with electric cars you can deduct the full cost from your pre-tax profits. On a car costing around 40000 this could amount to a tax relief of 7600 in the first year. Electric cars do not pay road tax.

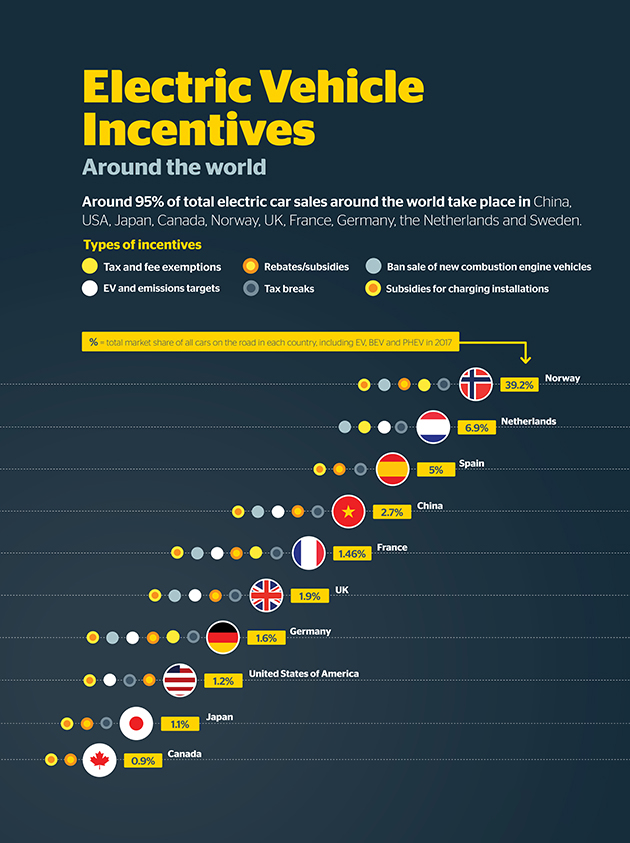

The grant applies to all electric car orders placed between 14th June 2022 and 31st March 2023 with the same terms as before. In the United States for example the federal government offers a 7500 tax credit for the purchase of an all- electric vehicle. Incentives did exist for consumer-facing plug-in cars in the UK but as of 14 June 2022 theyve been.

Hybrid vehicles are road taxed according to their CO2 emissions and there are a number of different tax bands. Additionally those earning less than.

9 Reasons Why Your Next Car Lease Should Be Electric Pink Car Leasing

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2020 Acea European Automobile Manufacturers Association

How Much Is The Benefit In Kind Company Car Tax On An Electric Car Drivingelectric

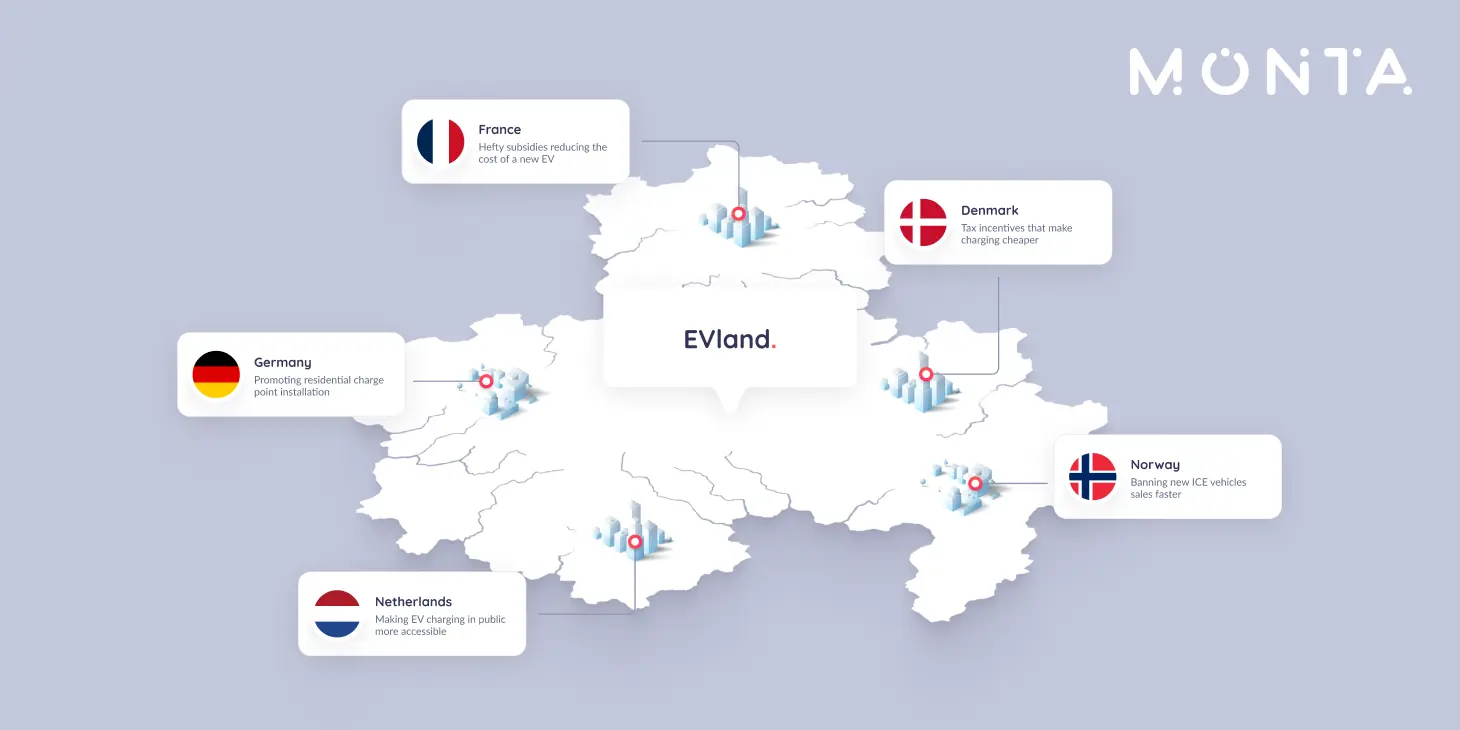

The Home Of Europe S Best Ev Policies Welcome To Evland Monta

Electric Car Tax Benefits Green Car Guide

Drivers Still Sceptical About Electric Vehicle Savings Autocar

The Uk Just Eliminated Its Ev Rebate Incentive Engadget

Company Car Tax Incentives For Electric Hybrid Vehicles Stewart Co

Motoring Ev Incentives Around The World Infographic

Could You Live With An Electric Car The Pros And Cons Of Owning An Ev Today Auto Express

Electric Vehicle Costs Ev Taxes And Incentives Uk 2021

Electric Car Tax What S In Store For 2021 23 Mer

How Europe Promotes Electric Vehicles A Brief Insight On Best Practices Rail Road Cycling Turkey

Sas Accounting Services Ltd What Are The Tax Efficiencies Of Swapping To An Electric Car

What Other Countries Are Doing To Encourage Electric Vehicle Sales Rac Wa

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

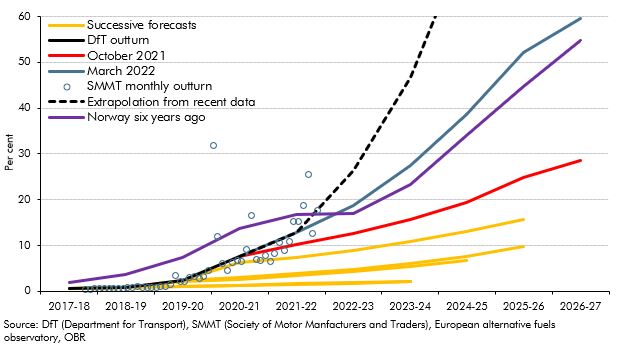

Electric Cars 2023 2043 Idtechex

What Does Faster Take Up Of Electric Cars Mean For Tax Receipts Office For Budget Responsibility