self employment tax deferral covid

To give people a needed temporary financial boost the Coronavirus Aid Relief and Economic Security Act allowed employers to defer payment of the employers share of Social Security tax. Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on.

How To Defer Social Security Tax Covid 19 Bench Accounting

You can reasonably allocate 77500 775 x 100000 to the deferral period March 26 2020 to December 31 2020.

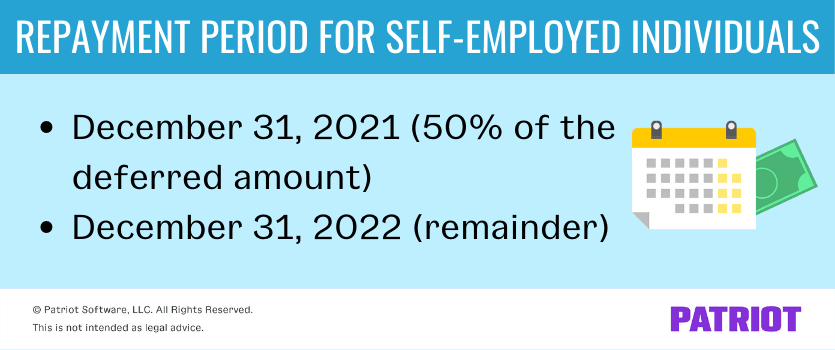

. 31 2021 and the remainder is due by Dec. Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax. Self-employed taxpayers can defer half of this amount ie.

Social Security tax deferral. IRS Notice 2020-65 PDF allowed employers to defer withholding and payment of the employees Social Security taxes on certain. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27 2020 and ending December 31 2020 However the deferred payments must still be made by the dates.

You can get immediate access to the credit by reducing the employment tax deposits you are otherwise required to make. In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self-employment. Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by.

Half of that deferral is now due on January 3 2022 and the other half on January 3 2023. IRS Form SE Self-Employment Tax Part III allows self-employed individuals to compute a maximum amount of self-employment tax payments that can be deferred. Self-Employment Tax Deferral.

62 of their taxable income for the eligible period. Your average daily self-employment income is 385 which is 100000. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years.

As a self-employed individual only 9235 of your earnings are subject to social security tax. The Families First Coronavirus Response Act FFCRA provides 100 of the funds needed by employers with fewer than 500 employees to pay federally mandated emergency leave to employees caring for themselves or others for COVID. Additionally you pay 124 of social security tax on your earnings.

WASHINGTON The Internal Revenue Service announced today that a new form is available for eligible self-employed individuals to claim sick and family leave tax credits under the Families First Coronavirus Response Act FFCRA. You were sick and unable to work for five days because you experienced symptoms of COVID-19. When I went back to the 2020 file months later during the 2021 filing season a subsequent update must have triggered the estimated tax calculation to take into account the non-existent deferral.

COVID Tax Tip 2021-32 March 10 2021. An Affected Taxpayer employer may defer the withholding and payment of Applicable Taxes employee share of FICA on Applicable Wages less than 4000 paid per bi-weekly pay-period from 1. So in this example your client could defer a.

Self-employed taxpayers can also postpone the payment of 50 of the Social Security portion of their self-employment tax for the same period. So you would be taxed on 7157121 77500 x 09235. The deferral effectively reduces the required amount to.

The Coronavirus Aid Relief and Economic Security CARES Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on Form 1040 for tax year 2020 over the next two years. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. What the Coronavirus Relief Means for Self-Employed Taxpayers Are Self-Employed workers eligible for the Paycheck Protection Program Unemployment Benefits and Insurance The Coronavirus Aid Relief and Economic Security Act CARES Act expanded unemployment benefits to Self-Employed who are usually ineligible for unemployment benefits.

Half of the deferred Social Security tax is due by Dec. Self-employment income deferred tax for Covid. How a payroll tax relief deferral may help self-employed people.

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. The tax return as originally filed had correctly calculated 2021 suggested estimated tax based on the fact that this deferral was not included. Two COVID-19 aid packages recently became law that deliver federal assistance to employers by providing them credits against their payroll taxes.

46521 x 062 2884. As part of the COVID relief provided during 2020 employers and self-employed people could choose to put off paying the employers share of their eligible Social Security tax liability normally 62 of wages. The Social Security portion of self-employment tax is 124 of taxable income.

The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave under the FFCRA. Line 18 requires taxpayers choosing this deferral to make a reasonable computation of their self-employment income made from March 27 2020 through. IR-2021-31 February 8 2021.

Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022. While employers and employees generally split in equal shares the 124 Social Security tax people who are self-employed must pay the entire amount themselves. The CARES Act allows self-employed people to defer half of their Social Security tax on net earnings from their self-employment income between March 27 and Dec.

COVID Tax Tip 2021-96 July 6 2021.

How Self Employed Individuals And Household Employers Can Repay Deferred Social Security Tax Tax Pro Center Intuit

Self Employed May Be Eligible For Covid Related Tax Breaks For 2020

Payroll Tax Deferral How Will It Affect You Experian

What Is Payroll Tax Relief And When Does It Apply Turbotax Tax Tips Videos

Self Employed Social Security Tax Deferral Repayment Info

Payroll Tax Deferral Deposits Due By Jan 3 2022 Baker Tilly

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Deferred Social Security Tax Payment Due Jan 3 For Self Employed Employers Local News Stories Willistonherald Com

Guidance For Repayment Of Deferred Payroll Self Employment Taxes

Deferral Of Se Tax Intuit Accountants Community

How The Coronavirus Payroll Tax Deferral Affects Pastors The Pastor S Wallet

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

Self Employed Social Security Tax Deferral Repayment Info

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia

What The Self Employed Tax Deferral Means Taxact Blog

Tax Deferral From 2020 Time To Pay Up Barbara Weltman

Irs New Employer Tax Credits St Louis Economic Development Partnership